Last Updated on February 8, 2026 by Rajeev Bagra

Understanding correlation is essential in data analysis, finance, marketing, and business intelligence.

In this tutorial, you will learn:

✅ What Pearson correlation really measures

✅ Why “no correlation” happens

✅ How the formula works

✅ When Pearson fails

✅ How professionals use it in finance

✅ How to interpret graphs correctly

🔹 1. What Is Pearson Correlation?

The Pearson Correlation Coefficient (r) measures:

How strongly two variables move together in a straight-line pattern.

Its value lies between:

| Value | Meaning |

|---|---|

| +1 | Perfect positive |

| 0 | No linear relation |

| –1 | Perfect negative |

Example:

- Ads ↑ → Sales ↑ → Positive

- Rates ↑ → Loans ↓ → Negative

🔹 2. Important Rule: Pearson Is About X vs Y (Not Time)

Many beginners think:

“If X and Y are both straight over time, they are correlated.”

❌ This is wrong.

Pearson does NOT care about time.

It only looks at:

How Y changes when X changes.

So always think:

📌 Plot Y against X — not against time.

🔹 3. The Pearson Formula

What It Means in Simple Words

Correlation = (How X and Y move together) ÷ (How much they move separately)

🔹 4. How the Formula Detects Relationship

The key part is:

This multiplies deviations.| X moves | Y moves | Result |

|---|---|---|

| Up | Up | + |

| Down | Down | + |

| Up | Down | – |

| Down | Up | – |

If many + → Positive r

If many – → Negative r

If + and – cancel → r ≈ 0

That is how “no correlation” appears.

📈 5. Understanding Correlation Using Graphs

Always draw a scatter plot before trusting r.

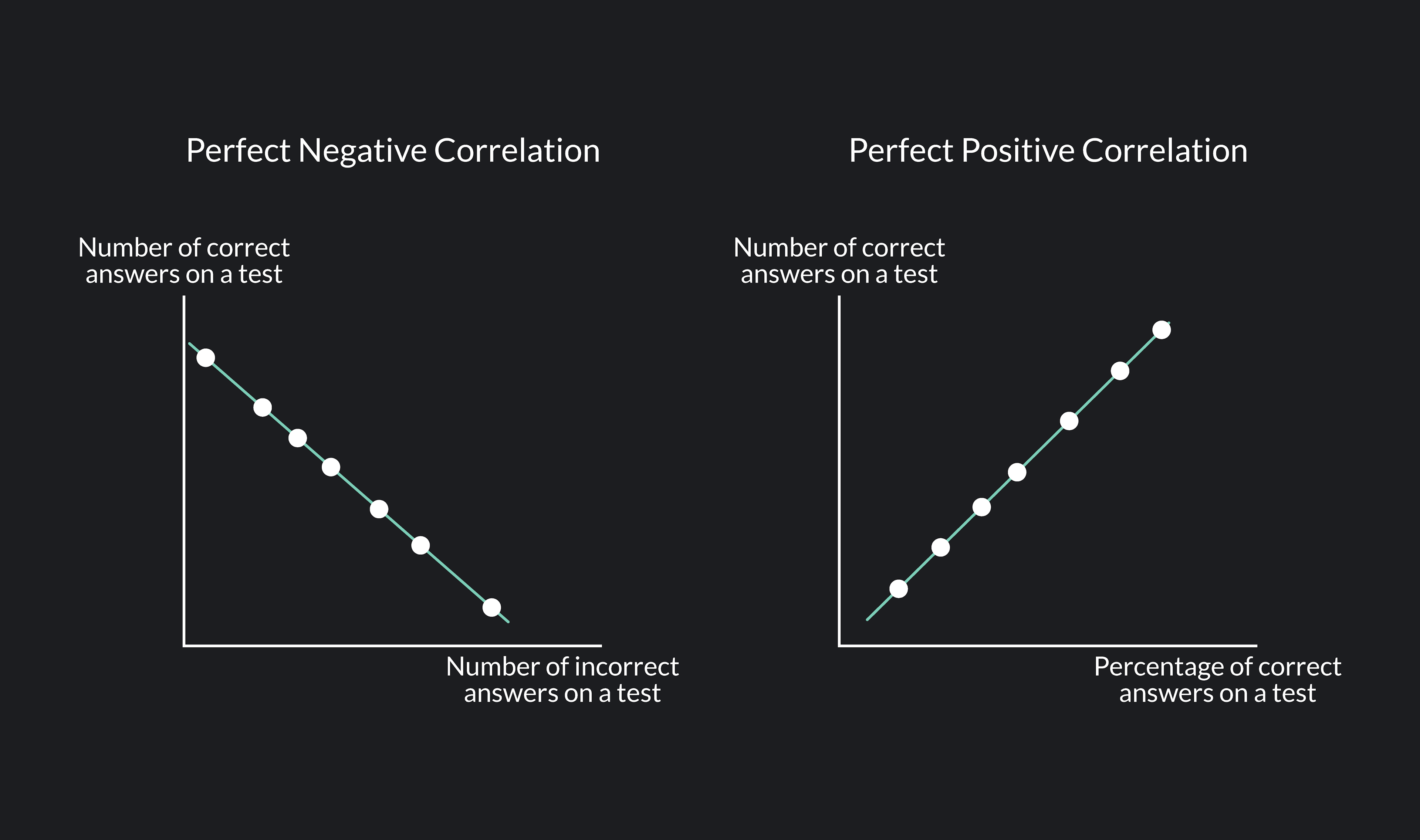

✅ A. Perfect Positive Correlation ( r = +1 )

Example Dataset

| X | Y |

|---|---|

| 1 | 2 |

| 2 | 4 |

| 3 | 6 |

| 4 | 8 |

| 5 | 10 |

Here:

All points lie on one rising line.❌ B. Perfect Negative Correlation ( r = –1 )

Example Dataset

| X | Y |

|---|---|

| 1 | 10 |

| 2 | 8 |

| 3 | 6 |

| 4 | 4 |

| 5 | 2 |

Here:

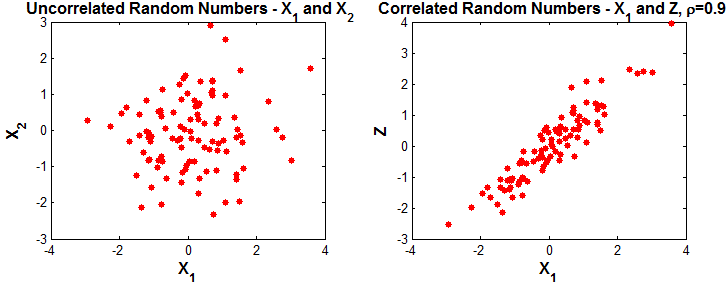

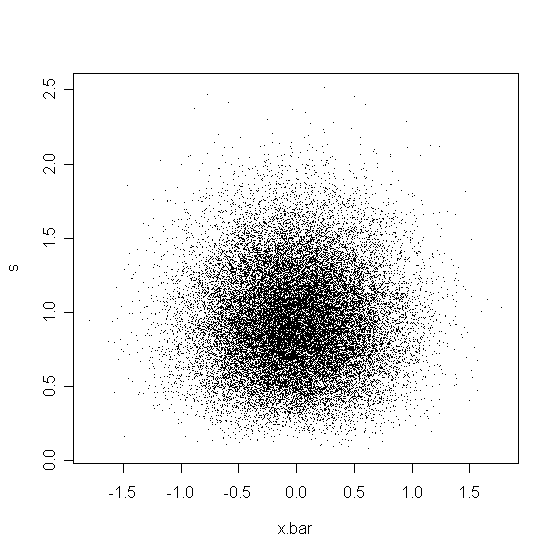

One rises, the other falls.⚪ C. No Linear Correlation ( r ≈ 0 )

Example Dataset

| X | Y |

|---|---|

| 1 | 7 |

| 2 | 3 |

| 3 | 9 |

| 4 | 4 |

| 5 | 6 |

Here:

Products cancel → no straight-line pattern.

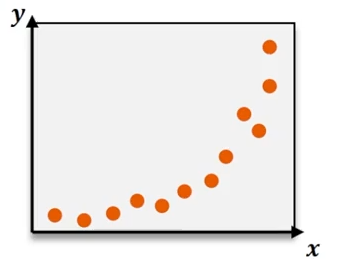

🔀 D. Non-Linear Relationship ( Pearson Fails )

Example

| X | Y |

|---|---|

| 1 | 1 |

| 2 | 4 |

| 3 | 9 |

| 4 | 16 |

| 5 | 25 |

Here:

Strong relationship ❗

But Pearson → r ≈ 0 ❌Because it is curved.

🔹 6. Correlation ≠ Causation

Correlation does NOT mean cause.

Example:

- Ice cream sales ↑

- Drowning ↑

Both caused by summer.

Not by each other.

💼 7. How Finance Professionals Use Correlation

🏦 A. Portfolio Diversification

Goal: Reduce risk.

| r Value | Meaning |

|---|---|

| > 0.8 | Risky |

| < 0.3 | Good |

| < 0 | Hedge |

They prefer:

Campaign works.🔹 8. How Professionals Decide “No Relationship”

They NEVER trust r alone.

They check:

✅ |r| < 0.2

✅ p-value > 0.05

✅ Scatter plot

✅ Stability over time

✅ Business logic

Only then:

“Probably independent.”

🔹 9. When NOT to Use Pearson

Do NOT use Pearson when:

❌ Data is curved

❌ Data is ranked

❌ Data has outliers

❌ Regimes change

Use instead:

- Spearman

- Regression

- Nonlinear models

🔹 10. Step-by-Step Method for Learners

Before using Pearson, always follow this:

Step 1

Plot X vs Y

Step 2

Ask: “Is it roughly straight?”

Step 3

If yes → Use Pearson

Step 4

Compute r

Step 5

Check if |r| > 0.3

Step 6

Interpret with business logic

📌 Final Summary

| Topic | Key Idea |

|---|---|

| Pearson Measures | Linear relationship |

| r ≈ 0 Means | No straight-line pattern |

| Not Meaning | No relationship at all |

| Always Do | Plot first |

| Finance Use | Risk control |

✅ Final Takeaway

Pearson correlation tells you how well two variables move together in a straight line. A value near zero means no strong linear pattern, not necessarily no relationship.

Discover more from Progaiz.com

Subscribe to get the latest posts sent to your email.

Leave a Reply